26 October 2023

Flow Traders announces its unaudited Q323 trading update.

Highlights

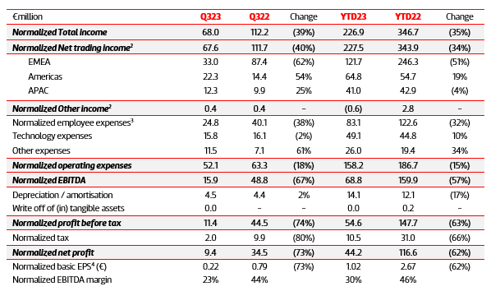

- Flow Traders recorded Normalized Net Trading Income of €67.6m and Normalized Total Income of €68.0m in Q323.

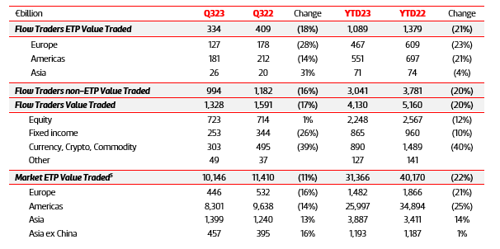

- Flow Traders’ ETP Value Traded declined 18% y/y given the decline in the overall market trading environment.

- Normalized Operating Expenses were €52.1m in Q323, with Normalized Fixed Operating Expenses of €46.7m.

- Flow Traders employed 658 FTEs at the end of Q323, compared to 653 at the end of Q223.

- Normalized EBITDA in Q323 came in at €15.9m, generating a Normalized EBITDA margin of 23%.

- Q323 Normalized Net Profit was €9.4m, with Normalized basic EPS of €0.22.

- Trading capital stood at €585m at the end of the quarter, up from €574m at the end of Q223 and generating a 59% return on trading capital1.

- Shareholders’ equity was €590m at the end of the quarter, up from €586m at the end of Q223.

Financial Overview

Value Traded Overview

Market Environment

- Market-wide, trading volumes and volatility across almost all regions and asset classes remained muted in the quarter. While trading volumes improved compared to last quarter, they remain down significantly compared to the same period a year ago. Market volatility, on the other hand, continued to decline compared to last quarter. Average VIX reached a low of 14 in the month of July before rebounding slightly in August and September.

- Looking across the regions, the same market-wide dynamic was seen within each region, with some regions faring better than others. The Americas saw a stronger rebound in trading volumes in the quarter compared to EMEA as it experienced a more severe decline in the prior quarter. APAC saw a similar rebound in the quarter compared to the last quarter and continues to outperform all other regions, driven in part by a strong rebound in trading volumes in China.

- Volumes and volatility also remained depressed from an asset class perspective. In a continuation from last quarter, fixed income fared slightly better than other asset classes in terms of volumes but volatility was down significantly compared to a year ago, similar to the other classes. Cryptocurrencies continue to see the most pressure as Bitcoin, the bellwether of the industry, continued the downward trend in trading volumes and volatility as compared to the prior quarter.

Share Buyback

- After a brief pause during a period of unusually subdued market trading environment, execution of the €15m share buyback program that was previously extended until 26 October 2024 will commence shortly.

Outlook

- Continued focus on operational and cost efficiencies across the business while implementing growth strategies. Expect Normalized Fixed Operating Expenses to remain in the range of €175-185m and headcount to be broadly flat for the year, in-line with previous guidance.

Management Comments

“We saw an improved trading environment in the third quarter when compared to the second quarter, though volumes and volatility were still down significantly compared to the same period last year. We are, however, encouraged to see a slight improvement in volatility recently after a period of subdued market activity. We are also pleased to see our diversification strategy yielded solid results during a seasonally quiet period which we may not have been able to achieve otherwise when looking at the varying degrees of rebounds in different segments of the market globally. While the structural growth of ETPs across different asset classes around the world continues unabated, the recent surge of investor interest in bonds and digital assets, offset in turn by less interest in equity, validates the strategic and economic relevance of our diversification strategy.

Throughout the quarter, we remained focused on structurally enhancing our trading capabilities and related infrastructure in different asset classes and regions to take full advantage of arising opportunities when market volumes and volatility return. In Europe, given the continued increase of institutional interest towards the digital assets space, we are increasingly focused on supporting trading of new products and accelerating the related infrastructure build-up, which we will provide more information on in the coming quarters. We continue to be optimistic in relation to the regulatory development in both Europe and progressive conversations in the Americas on digital assets. In the Americas, we appointed Bill Stush as the firm’s regional CEO and continue to be focused on systematically enhancing our ETP proposition in North America and Latam as well as building our algorithmic fixed income trading capabilities. In APAC, we remained focused on building out our China operations amidst a rebound in trading volumes there.

The firm continues to remain fully focused on operational and cost efficiencies across the business while implementing its prioritized growth strategies. Normalized Fixed Operating Expenses are expected to remain in the range of €175-185m for the full year and headcount is expected to remain broadly flat for the year, in-line with previous guidance. We believe the continuous fostering of talent through all cycles of the market that has underpinned the success of Flow Traders remains as important as ever.

During the quarter, the firm’s leadership experienced a transition as Folkert Joling left the firm as Chief Trading Officer after a 17-year tenure and Hermien Smeets-Flier was approved by our shareholders and formally elected as Chief Financial Officer and member of the Flow Traders Board. Hermien will focus on further expanding the effectiveness of our global control functions in the coming months and we are delighted that she has joined our firm. I continue to be excited to be able to lead Flow Traders at this important juncture in its growth trajectory with a variety of tangible growth opportunities ahead of us. Together with the Flow Traders’ leadership team, I therefore very much look forward to unlocking the full potential of the firm’s growth initiatives as we build a truly global diversified liquidity provider and market maker.”